A wide variety of research articles are being published on the performance and future expectations of the textile & clothing industries in India. Some are focusing on investment or employment, others on the supply chain performance or export growth. Werner International has taken a different perspective when looking at the future of the textile & clothing industries in India: as the textile & clothing industries are one of the highest globalized industry sectors, we have started from a range of major global trends that will impact on the performance and growth of the industry sectors globally and focusing on what influence this may have on the textile & clothing sectors in India.

The global trends we will consider within this article are:

- the future growth/stagnation of textile fiber consumption

- investment patterns and market shares

- the future position of cotton

- the impact of the circular economy on the textile industry

The future vision of any major textile producing economy should encompass different scenario's to incorporate the consequences following from this.

1. TEXTILE FIBER CONSUMPTION

World textile fiber consumption is driven by two major economic variables: income and population growth. Global world fiber demand is thus a continuously growing market due to the

population growth and the increasing level of development worldwide. The compound annual growth rate of per capita fiber consumption between 1960 and 2013 was 1.54% per annum.

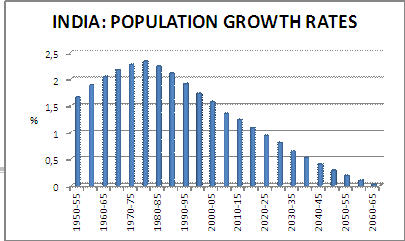

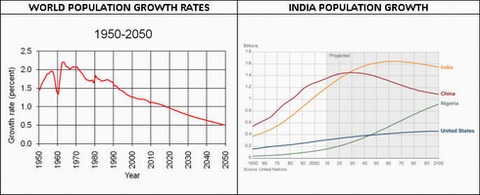

a) Stagnating world population growth by 2050

Globally, the growth rate of the human population has been declining since peaking in 1963 to 2.2% per annum. At present estimated annual growth rate is just above 1%. Population growth rates have been dropping in all regions of the world since then, and this trend is predicted to continue. Current UN expectations are that the human population will level off at about 9.5 billion people by 2050, and stabilize or slowly decline thereafter.

India is expected to become the world’s largest country, passing China around 2028, when both countries will have populations of 1.45 billion. After that, India’s population will continue to grow until 2050/2060 and China’s is expected to start decreasing by 2030. As a result, this means that fiber consumption in India will be fueled by population growth for another 2 to 3 decades.

India is expected to become the world’s largest country, passing China around 2028, when both countries will have populations of 1.45 billion. After that, India’s population will continue to grow until 2050/2060 and China’s is expected to start decreasing by 2030. As a result, this means that fiber consumption in India will be fueled by population growth for another 2 to 3 decades.

b) Continued economic growth

The world economy continued its recovery in 2013 and 2014, but at a slightly slower pace than expected. According to the World Bank, global growth is expected to rise to 3.9% in 2015. The IMF projects that output of emerging and developing economies will expand at 5.1% in 2014 and 5.4% in 2015. In advanced economies, growth is projected at 2.2% in 2014 and 2.3% in 2015. Forecasted growth in India is projected at 5.5 percent in 2014-15, accelerating to 6.3 percent in 2015-16 and 6.6 percent in 2016-17.

c) Textile Fiber Consumption

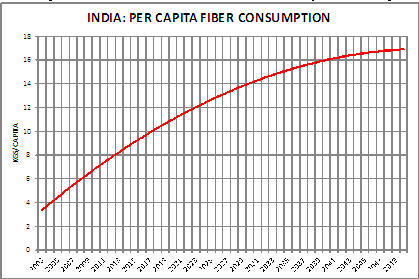

Werner’s textile fiber forecasting model, based on population growth and growth in income, has been comparing the various countries and levels of development over time. Each country or region in the world is showing a similar pattern in growing per capita textile fiber consumption. We see that initially there is a strong growth in per capita fiber consumption, but at a certain stage in its development, the growth in fiber consumption will slow down and consumption of textiles will remain constant. The growth is following a logarithmic curve over time.

If we take the USA with an annual per capita fiber consumption of around 34 kgs as the highest developed country, we see that this consumption remains rather flat over the last years. European countries have increased their fiber consumption substantially in the last century, but even in Germany this has now leveled off at around 24 kgs/per capita. Japan, Taiwan and South Korea have matured at around 21 kgs/capita. It is not expected that Europe or Japan/SK/Taiwan will ever reach the level of the USA, but when comparing over time, we see the same development, but offset in time and at a lower consumption level. The same we expect to happen with growth in China and India, again with high growth figures now, but leveling off over time at a lower level again. We expect world per capita fiber consumption to stabilise at around 15 to 16kgs/per capita by 2050, while at present we are at around 11kgs/per capita.

Per capita textile fiber consumption in India is estimated at around 7,5 kgs per annum. We forecast this to double in India over the next few decades and to stabilise around world average levels by 2050.

2. INVESTMENT AND MARKET SHARES

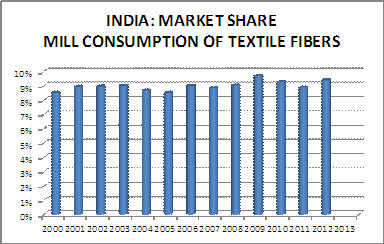

A regional breakdown of production, consumption, trade and installed technology base all show a highly concentrated picture with China taking more than half of world mill consumption followed by India. High labor cost countries still account for 15% of total world mill consumption. India has consistently kept a 9% global market share since the mid-nineties of last century. This in contrast with China which has increased market share from around 25% to over 55% in the same period.

A regional breakdown of production, consumption, trade and installed technology base all show a highly concentrated picture with China taking more than half of world mill consumption followed by India. High labor cost countries still account for 15% of total world mill consumption. India has consistently kept a 9% global market share since the mid-nineties of last century. This in contrast with China which has increased market share from around 25% to over 55% in the same period.

Major relocation shifts have been experienced during the last few decades. Future relocation is still important (towards Africa) but this will never have the same impact as the development and relocation to Asian countries, since we do not see the capabilities to make similar investments in new countries. While labor costs in industrialized countries were more than ten, twenty or even thirty times those of Asian countries, investment in relocation paid off. The difference in labor costs between African and Asian countries is much lower. With the clothing industry being more labor intensive, in the medium-term future some further relocation may take place.

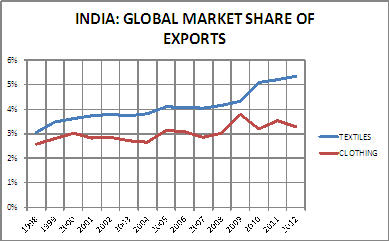

India’s market share of global exports (in US$) is still low and the share in clothing exports has seen little growth over the last decades, as can be observed from the table below. For clothing the market share remained at around 3%, for textiles (including home textiles), this has expanded from 3 to 5% since the mid-nineties.

For India to maintain and grow its market share, it is an absolute prerequisite to be able to produce at a global competitive operating cost. In theory India should be in an ideal position to so, however we see that two cost factors are not within control:

For India to maintain and grow its market share, it is an absolute prerequisite to be able to produce at a global competitive operating cost. In theory India should be in an ideal position to so, however we see that two cost factors are not within control:

- financing costs

- energy costs

Both cost factors are not within the control of the Indian textile & clothing companies and the Indian government should find a way to support its industry by reducing the above costs for industry.

3. COTTON GROWING AND CLIMATE CHANGE

The share of cotton in global fiber consumption dropped from 68% in 1960 to 30% in 2012. The share of cotton will drop further to 25% by 2020 and 18% by 2050. The harvested area for cotton has only been increasing slightly, from 33 million ha in 1965 to 35 million ha in 2012 but is again forecasted to be 33.1 million hectares in the 2013/2014 season. However, due to a higher yield per ha, cotton output has been growing by 105% since 1965. Cotton yield is now at 770 kgs/ha, but again, this has not been growing over the last 10 years. Over the last few years the cotton yield has been declining slightly.

Yield increases for food crops are insufficient to keep up with world population by 2050. As a result, cotton may find itself in even stronger competition for available and limited growing area in the future. In the USA for example, costs of cotton production have not kept pace with yields, thus resulting in growing competition from other crops for land. It is expected that in the USA in the medium to longer term production will shift from cotton to other crops (corn, faming) since prices for competing crops are expected to rise.

Yield increases for food crops are insufficient to keep up with world population by 2050. As a result, cotton may find itself in even stronger competition for available and limited growing area in the future. In the USA for example, costs of cotton production have not kept pace with yields, thus resulting in growing competition from other crops for land. It is expected that in the USA in the medium to longer term production will shift from cotton to other crops (corn, faming) since prices for competing crops are expected to rise.

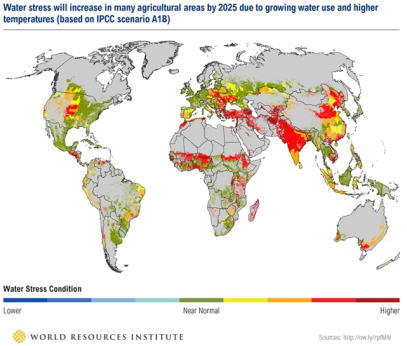

But most importantly, there is an important negative impact of climate change on cotton production, mainly due to the forecasted reduced availability of water for irrigation. Climate change is expected to negatively impact crop yields, with growing water use and rising temperatures expected to further increase water stress in many agricultural areas by 2025. The following graph shows clearly that the major cotton producing areas will come under pressure because of growing water needs. As a result we do not expect the production of cotton to increase at any substantial rate and are assuming that future cotton production and consumption will remain flat in an optimistic scenario.

Any future growth in textile fiber consumption will thus be satisfied by manmade fibers, more specific by filament fabrics. We expect the share of filament fiber, now at 43%, to increase to will almost 60% by 2050.

It is clear that India's future positioning should focus on keeping the market share in cotton and increasing its market share in man-made fibers. Cotton products becoming more and more premium products or being used more in close-to-skin products could change the market positioning and price levels of Indian products substantially over the next decade. Focus on quality and efficiency in manufacturing are an absolute requirement for supporting premium products in high value consumer markets. At the same time investment programs, both in cotton and synthetics will need to be realigned for optimal future competitive positioning.

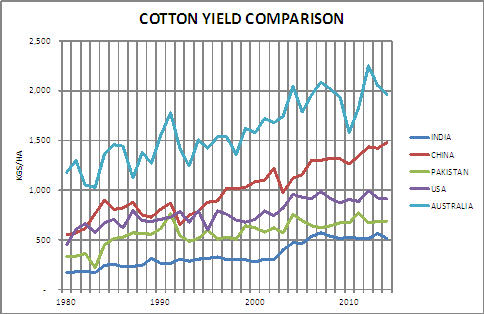

Looking at the cotton production in India, we see that the country experienced a rapid growth in yields between 2002 and 2008, due to the introduction of biotech cotton and improved hybrid varieties and improved crop management. This increase in yield however has stopped since then. The level of production technology, modernization and management in the cotton growing industry in India is well below world benchmarks. The cotton growing needs more investments to improve procedures, harvesting, remove contaminations, etc. Compared to yields in other countries like China and Pakistan, there is still a significant growth potential in India. In view of cotton becoming more a premium product, this should be exploited to the maximum.

4. CIRCULAR ECONOMY

Not only is the textile sector a water intensive industry it is also wasteful and not very environmental friendly. Cotton growing will be under more pressure from water and land scarcity. The principle ingredient used in the manufacture of synthetics is derived from petroleum and the production process is energy-intensive.

The linear ‘take, make, and dispose’ manufacturing model in textiles & clothing is thus relaying on large quantities of easily accessible resources (cotton, man-made fibers) and energy. Each year, more than 80 billion kgs of fiber are being produced from virgin materials. This is in sharp contrast with the circular economy, being one of the flagships of industrial production in the industrialized world. The circular economy refers to an industrial economy with one of its major principles an optimal resource utilization and eradication of waste. The concept has been recognized earlier in other industries (like metal and rare earth materials) due to the higher cost of virgin raw material. With the increasing environmental pressure, the growing competition from food crops and water scarcity, it is only a matter of time before the circular economy will be implemented in the textile industry.

In the textile & clothing industries, many initiatives have already engaged in this new model. However the largest gains can be made from the recycling of textile fibers. At present however, most of the recycling is through a mechanical process, shortening the fibers resulting in a maximum content of only 20% of recycled fibers. Chemical recycling would produce an output more similar to virgin fibers but this technology is not yet developed enough for mass production at competitive prices. At present a range of governments is discouraging textile recycling in order to protect their fiber production industries. There are however no reasons why this will not be possible in the future.

What will the impact be of the increased usage of recycled textile fibers on the Indian textile industry? Is there a need to invest in India in research and production technologies supporting the re-use of textile fibers? Is the Indian textile industry sufficiently equipped to embrace textile recycling?

5. CONCLUSIONS

When looking at the future position of the Indian textile & clothing industries, it is important to keep a perspective on potential factors impacting on the consumer markets and industrial environment. With China accounting for over half of world production and together with India, Turkey, Pakistan and a few other countries accounting for over 85% of global production, concentration in manufacturing is high.

We have listed below three main areas of potential impact:

-

global economic,

- textile industry specific

- textile & clothing company specific

A number of these factors and their likely development have been described above. Some of them are very hard and even impossible to predict but overall the long term trends are clear.

Overall markets will continue to grow, but will become more and more saturated over time. Sustainable production and the effects of climate change will become more evident.

It is important for the Indian textile & clothing industry to include considerations at all three levels in developing future plans:

The above aspects provide a picture of the global developments India will be facing in the future. Government policies can address a number of these issues in a well-structured future vision and action plan. However, industry also has an important task to focus on

:

- further vertical integration in order to add the highest possible value to the products produced; this includes branding, export market development as well as upgrading of the local supply and demand.

- Further concentrate on high value sectors like the technical textiles sector

- improve investments in further technology and efficiency upgrading in weaving and finishing

For more information or questions on this article, please contact Werner International at

info@wernertex.com

~ ~ ~ ~ ~

Back to top

MAJOR TRENDS IN WEB AND DIGITAL MARKETING

FOR TEXTILES AND APPAREL

It is a fact that the global textile and apparel industry is still reluctant to embrace technologies related to web marketing even though they have the potential to increase the profitability of their business. However, the new technologies and the new ways to approach their target markets and clients cannot be neglected anymore by textile and apparel companies, especially as part of their communication strategy for brands.

Each marketing strategy, even when based on usual concepts such as positioning and target markets should use all those new tools that allow customizing the product and communicating the brand values to the right customer in the cheapest way. The web and all related media – website, e-commerce, blogging, and social networks - can be a powerful tool to reach out to customers and allow receiving immediate feedback from customers. The new mobile technologies in particular are the new disruptive force in the so-called “web ecosystem”: they are changing our shopping experience in a pace never witnessed before.

Mobile technologies combined with existent technologies such as RFID (Radio Frequence Identification), geo-positioning, MRI (Magnetic Resonance Imaging) and 3D Printing can change completely the shopping experience of customers.

In our technological ecosystem, big questions on the future always involve inevitably digital and mobile applications. Driven by a revolution of mobile technologies and the internet, today customers can easily access all the information needed to make the best purchase decision. The balance between brands and customers has shifted with customers gaining more power. The dawn of the

Age of the Customer highlights the importance of digital marketing as a prerequisite for successful business. Relying on old tactics and defining clients as a target, or worse, consumers, will inevitably result in a shrinking customer base.

Based on developments over the recent years, one can expect further technological progress in the near future in areas like big data and data flow, new technology applications, game mechanics, sophisticated and widespread cloud computing applications . These are five major trends that will change marketing and give new blood to the “digital customer experience”:

- Integrated engagement: the focus is moving towards platforms that ensure higher levels of engagement, integrating all the different aspects of the digital strategy. The path starts with the storytelling of the brand and continues over social media, inbound marketing, and responsive web tools to target mobile devices, online communities, advertising, etc. In each action, relevancy is the keyword to keep in mind when putting together all the pieces of an integrated approach.

- Innovative content: in traditional media, content was the king. In digital media, content becomes the emperor. This is even truer in the evolutionary stages of digital transformation, where customers become more demanding, where traditional outbound marketing looks outdated. In the years to come, one will witness an optimization in blending paid, owned and earned media together. Visual stories with a positive message will prevail, because loyalty runs hand-in-hand with emotions. At the same time, companies will get serious about virtual and augmented reality.

- People-based marketing: creating content alone will not be sufficient anymore. In the

Age of the Customer, marketing is not done for products but for people. “Personalization” is the code word, and this is even truer for a retail, fashion or luxury business. “Me-commerce” is the extreme refusal of mass standards. Technology is the bridge to connect customers, to foster engagement and loyalty, to enhance game dynamics and to provide location based content (i.e. push notification).

- Wearables marketing: digital marketing is not targeting customers as one single group. In markets defined by the shift of the mobile mind, clients can be reached with surgical precision through the applications on new mobile devices. Smartphones combined with iBeacons and wearable technology - smartwatches and activity trackers - will bolster real-time marketing and the awareness of context communication. Proximity marketing is the word for this personalized and mobile-first action plan.

- Data-aware strategy: the wide spread of new devices, the connection between smart objects (Internet of Things) and the implementation of the cloud on massive scale, will allow companies to collect and analyze huge amounts of data. Therefore every brand or company will have to adopt tools like an analytics dashboard to make sense of all the information gathered. Digital strategies won’t work without real time analytics, essential to improve efficiency and tailor-made experiences.

The emerging of these technologies is deeply changing the dynamics of markets and the speed needed to remain competitive. Social media, Internet of Things, gamification, analytics are different perspectives of a world that evolves quickly, tangled as a multi-dimensional spider's web.

The marketing goal is to create an amazing customer journey across all channels, touchpoints and devices by blending all these technologies and applications together. Tangible business results are the essence of all innovative digital customer experiences.

(Source - Neosperience.com)

Back to top

Management consultants to the world textile, apparel & fashion industry

Werner International is a management consulting practice specialized exclusively in the fiber, textile and fashion industry

globally active since 1939.

Werner’s services range from industrial and technology support

for setting-up, improving and restructuring

textile and clothing manufacturing operations

to strategy and marketing services for new market entry,

new product development, supply chain management,

branding, retailing, partner search

and future strategies build-up.

Werner is unique among world leading consulting companies

in being able to combine specialized expertise

in the technical areas with global marketing and

strategy know-how and supply chain integration.

Werner International, Inc.

13800 Coppermine Road

1st, 2nd, 3rd Floors

Herndon, VA 20171 USA

Phone + 1 703 871 3938

Fax + 1 703 871 3901

www.wernerinternational.com

info@wernertex.com

Copyright © 2014